indiana estate tax form

If you have additional questions or concerns about. Printable Indiana state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Complete Edit or Print Tax Forms Instantly.

. Contact an Indianapolis Estate Planning Attorney. An application should be filed in any year in which an appeal to the Indiana Board of Tax Review or to a court for an exemption determination on the property is pending from any. Indiana has three different individual income tax returns.

Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. Her and is not subject to Indiana inheritance or estate tax and further says under the penalties for perjury that. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate.

Does Indiana Have an Inheritance Tax or Estate Tax. The estate tax rate is based on the value of the decedents entire taxable estate. The final income tax.

Business Tangible Personal Property Return. Sales Disclosure Form 46021 or State Form 18865. Read the following to find the right one for you to file.

Indiana Department of Revenue. However most people will not fall victim to it simply because theyre estate is not. Ad Access IRS Tax Forms.

Sales Disclosure Form 46021 or State Form 18865 and Indiana Department of. An Indiana estate planning checklist is a document that can be referred to by residents when organizing their plans for end-of-life medical. Form 46021 or State Form 18865.

Updated November 04 2021. The top estate tax rate is 16 percent exemption threshold. 48845 Employees Withholding Exemption County Status Certificate.

In fact there is a clear reason why it is often called the death tax. Nobody likes the estate tax. For more information please join us for an upcoming FREE seminar.

430 pm EST or via our mailing address. Property tax forms are managed by the Indiana Department of Local Government Finance not the Department of Revenue. Which Indiana Tax Form Should You File.

An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than. Inheritance tax was repealed for individuals dying after Dec. These taxes may include.

Of all the states Connecticut has the highest exemption amount of 91 million. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have. Federal Estate Tax.

Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Form 706 is used by the executor of a decedents estate to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Therefore you must complete federal Form 1041 US.

Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. Federal Form 1041 US. PROPERTY TAX BENEFITS State Form 43708 R15 1-20 Prescribed by the Department of Local Government Finance COUNTY TOWNSHIP YEAR File Mark.

If you need to contact the IRS you can access. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41.

The exemption for the federal estate. Annual Withholding Tax Form Register and file this tax online via INTIME. Form 104 Must be filed with Form 102 or 103.

Indiana Substitute for Form. All Indiana real property for the. The Indiana income tax rate for.

Federal tax forms such as the 1040 or 1099 can be found. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Updated April 04 2022.

The Indiana living trust is an arrangement that places a Grantors assets within an entity to be distributed to Beneficiaries upon the death of the. We last updated the Taxpayers Notice to Initiate a Property Tax. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or.

Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets. 53854 Form 103-SR For use by taxpayers with personal property in more than one. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Updated December 16 2021. Instructions include rate schedules. Form IT-40 for Full-Year.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. If you need to contact the IRS you can access its website at wwwirsgov.

The statements herein are true and correct to the best of such persons. Indiana Current Year Tax Forms.

Sample Blank Power Of Attorney Form Power Of Attorney Form Power Of Attorney Attorneys

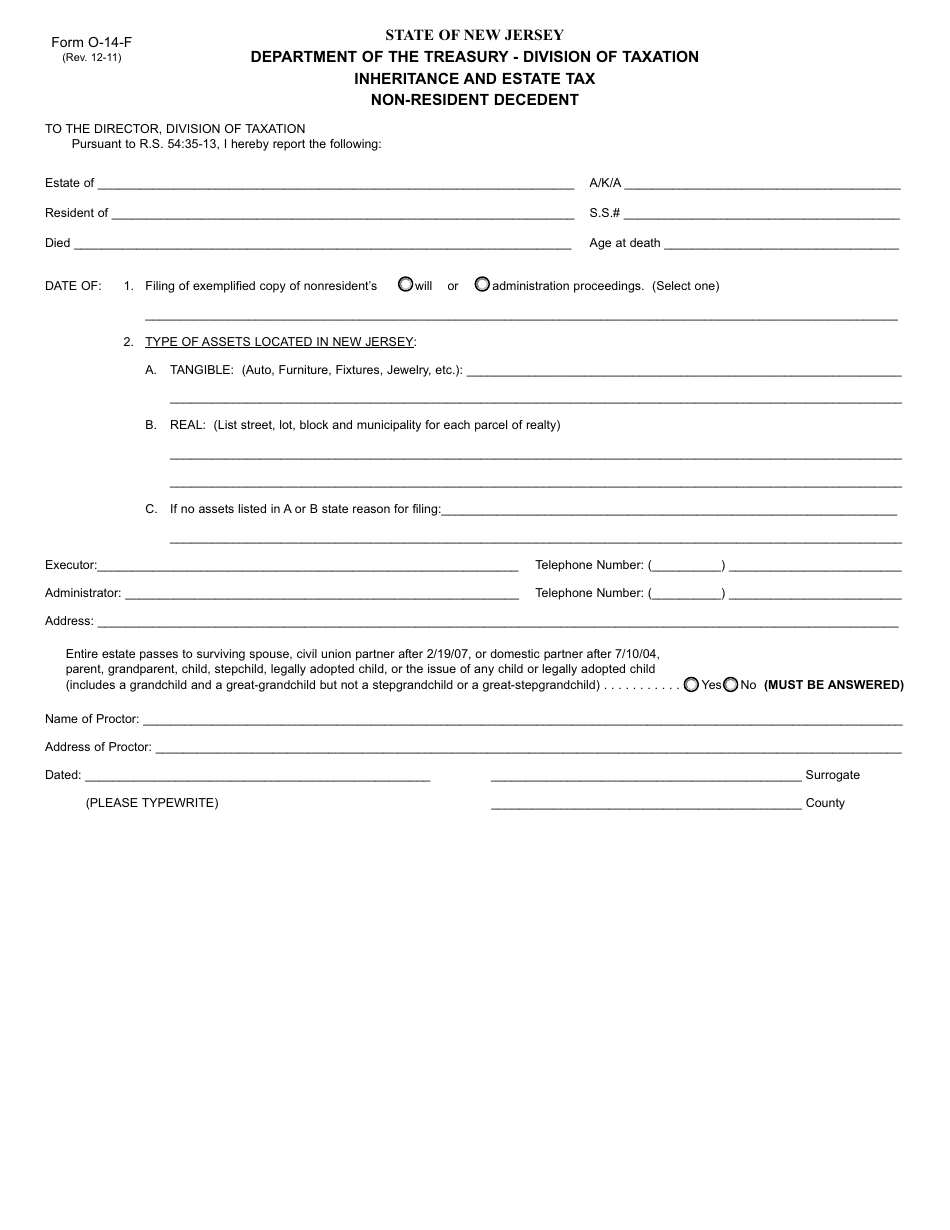

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

Irs Form 56 Instructions Overview Community Tax

Simple Purchase Agreement Template Stcharleschill Template Real Estate Contract Purchase Agreement Pamphlet Template

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Basics Of Estate Planning Trusts And Subtrusts American Academy Of Estate Planning Attorneys Estate Planning Estate Planning Attorney Revocable Living Trust

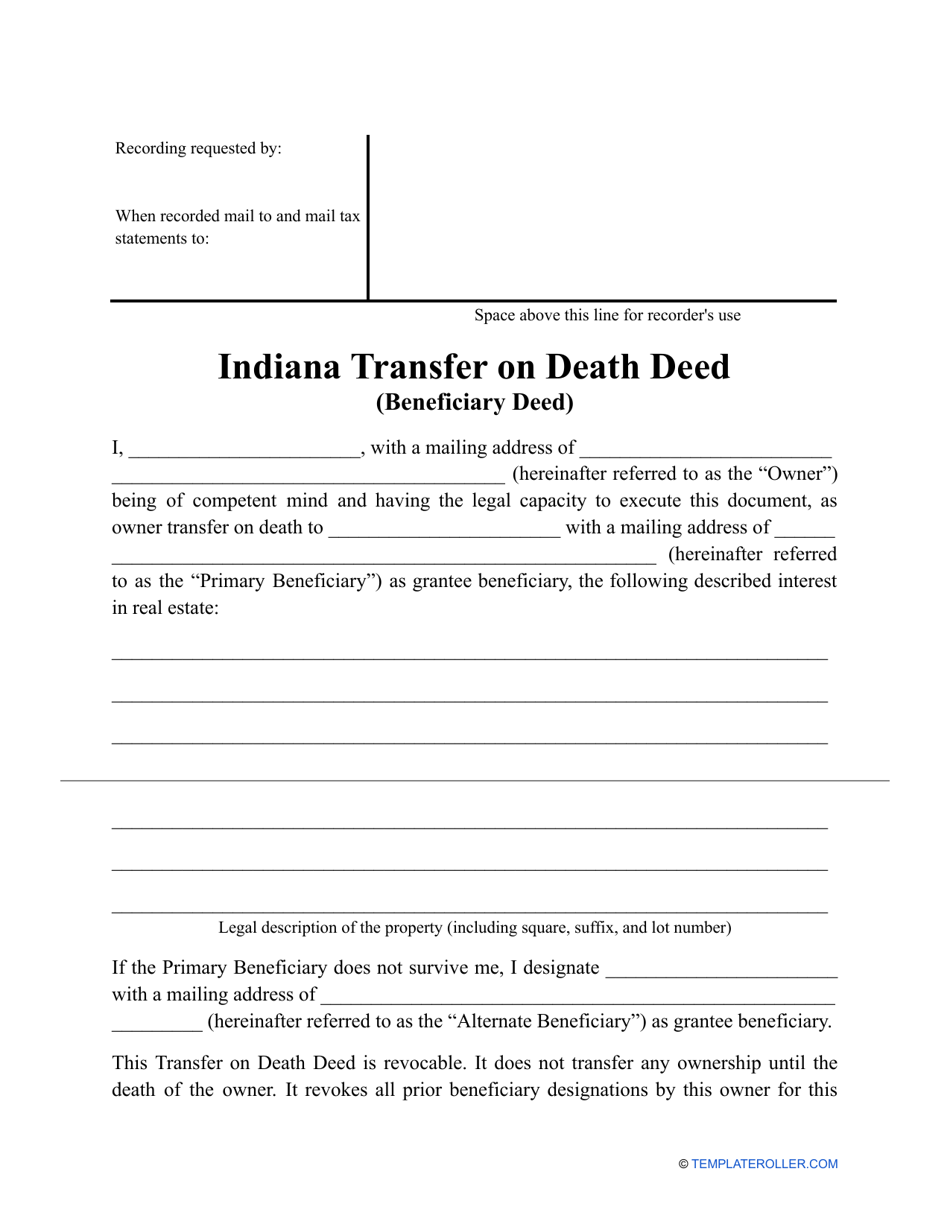

Indiana Transfer On Death Deed Form Download Printable Pdf Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Investment Banker Resume Example Resume Examples Job Resume Samples Good Resume Examples

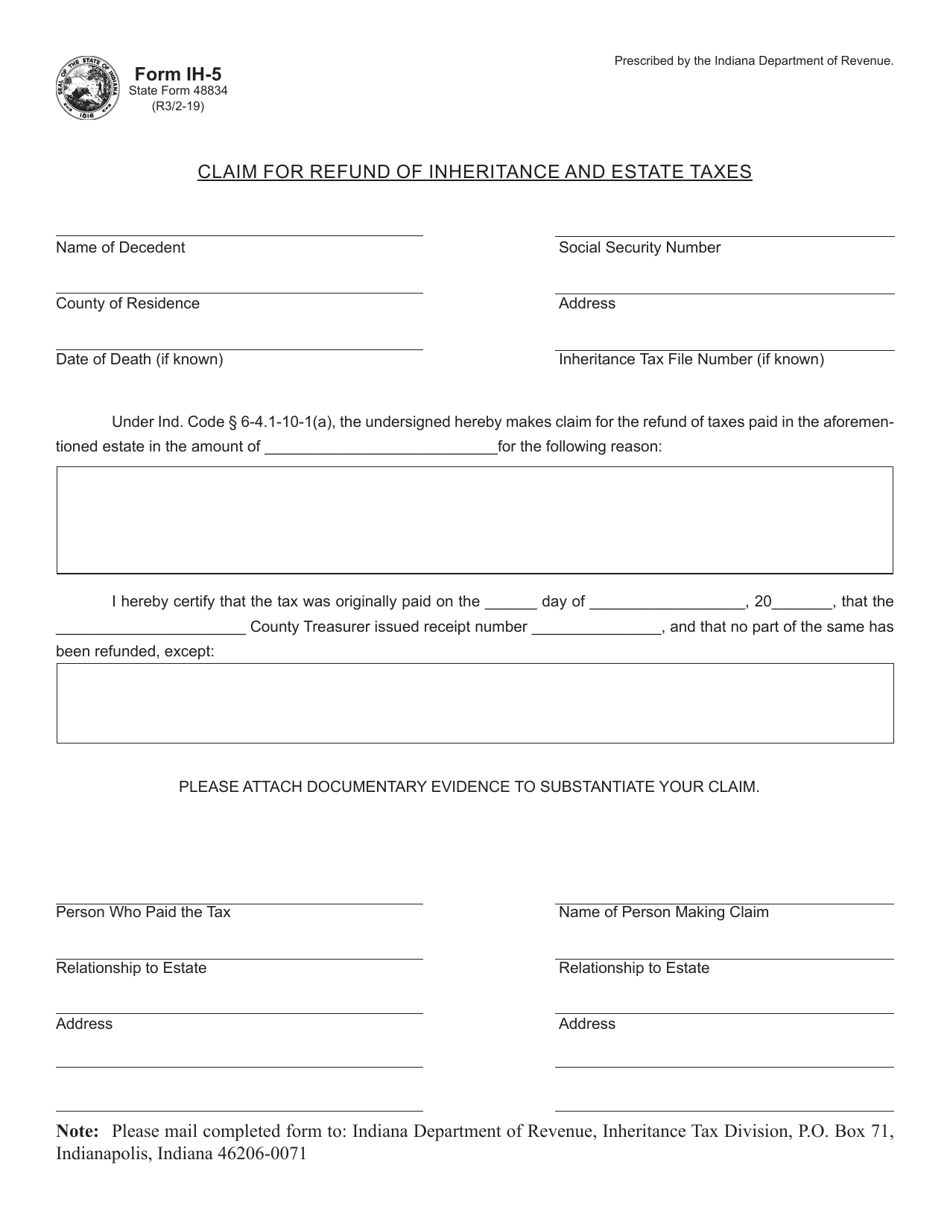

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service