personal property tax car richmond va

Ad Find Out the Market Value of Any Property and Past Sale Prices. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment.

Virginia Sales Tax On Cars Everything You Need To Know

Essex Ct Pizza Restaurants.

. Soldier For Life Fort Campbell. Please contact the Commissioner of Revenue at 804-333-3722 if you have a question about your assessment. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Opry Mills Breakfast Restaurants. At the calculated PPTRA rate of 30 you would be required to pay. Personal Property Tax Car Richmond Va.

January LES must be presented each year to verify tax relief. Boats trailers and airplanes are not prorated. Offered by City of Richmond Virginia.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. The personal property tax is calculated by multiplying the assessed value by the tax rate. Personal Property Taxes Personal Property taxes are billed annually with a due date of December 5 th.

Volunteer fire EMS police and rescue squad are also eligible for tax relief upon yearly presentation of a letter. Income Tax Rate Indonesia. View the Vehicle Qualification for Personal Property Tax Relief notice for details about tax relief.

Restaurants In Matthews Nc That Deliver. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

Second installment real estate tax payment due. Richmond City Virginia Property Tax Go To Different County 212600 Avg. Richmond VA 23225 804 230-1212.

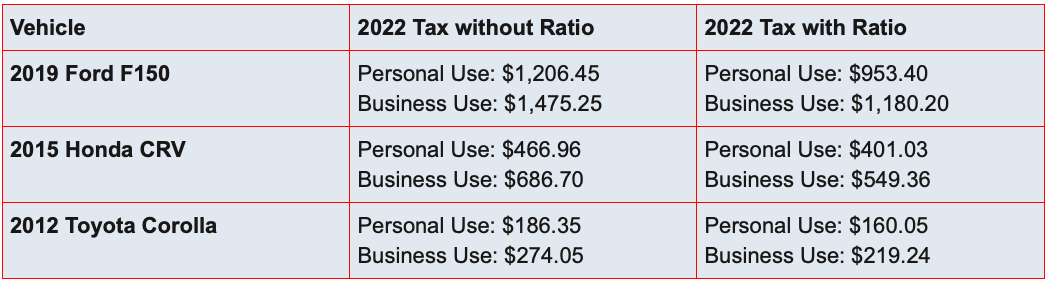

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. An example provided by the City of Richmond goes like this. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Personal Property Registration Form An ANNUAL filing is required on all. Personal Property Taxes are billed once a year with a December 5 th due date.

The PPTRA was passed by the General Assembly in 1998 as a way to allow localities to provide tangible personal property tax relief on qualifying vehicles by reducing its local tax rate on qualifying vehicles. Interest is assessed as of January 1 st at a rate of 10 per year. Is more than 50 of the vehicles annual mileage used as a business.

City Decal Enforcement Begins Vehicle December 5. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. Questions answered every 9 seconds.

Personal property tax car richmond va. 2 days agoTight used car market driving up personal property taxes and more Va. 105 of home value Yearly median tax in Richmond City The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. In James City County the Treasurer is responsible for the collection of all personal property taxes. Monday - Friday 8am - 5pm Mayor Levar Stoney.

Delivery Spanish Fork Restaurants. If you have an issue or a question related to your personal property tax bill call RVA311 by dialing 311 locally visit. Active duty military and spouses with states of record other than Virginia are eligible for personal property tax relief.

The 10 late payment penalty is applied December 6 th. In neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly amended Virginia law that. Glenn Youngkin is trying to make it easier.

Broad Street Richmond VA 23219. If you have questions about your personal property bill or would like to discuss the value. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

16 hours agoThe citys tax rate is 370 per 100 of assessed value for passenger vehicles boats farming equipment and trucks with a gross vehicle weight of less than 10000 lbs. The governing body of any county city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles trailers semitrailers and boats. Pay Personal Property Taxes.

In February Henrico also provided 20 million in real estate tax relief. See reviews photos directions phone numbers and more for Personal Property Tax locations in Richmond VA. Personal property tax bills are due by June 6 but no penalty or interest will be charged if taxes are paid in full by July 29.

Personal Property Taxes are billed once a year with a December 5 th due date. The county estimates that residents would receive a 52-cent reduction to their 2022 personal property tax rate as a result. A higher-valued property pays more tax than a lower-valued property.

For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. Ned Oliver Virginia Mercury The tight supply of used cars is causing some Virginians to take a hit on personal property taxes due to big increases in vehicles assessed value. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

It is an ad valorem tax meaning the tax amount is set according to the value of the property. If your vehicle is valued at 18030 the total tax would be 667. If you have questions about your personal property bill or would like to discuss the value.

Currently the personal property tax rate in the city is 370 per 100 of assessed value for passenger vehicles boats farming. Richmond residents will have until July 4 to pay their property taxes without penalty.

Henrico County Announces Plans On Personal Property Tax Relief

/cloudfront-us-east-1.images.arcpublishing.com/gray/SWWMJLSP2VFM3FNEXXD7CNZA7M.png)

Chesterfield County Personal Property Taxes Skyrocket As Used Car Assessment Values Surge

Henrico County Announces Plans On Personal Property Tax Relief

Many Left Frustrated As Personal Property Tax Bills Increase

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Pay Online Chesterfield County Va

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Virginia Car Registration Everything You Need To Know

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home

The Trick That Could Save You Money On Your Car Tax Bill

Henrico County Announces Plans On Personal Property Tax Relief

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Pay Online Chesterfield County Va

Decal Debate Other Counties Have Abandoned The Windshield Sticker Should Loudoun Join Them Loudoun Now

26 States That Won T Tax Your Social Security This Year Main Street Maine Michigan