tax deductions for high income earners 2019

The spouse or common-law partner would enter this amount in field 36000 of Schedule 2 and report this amount on line 32600 of their Income Tax and Benefit Return. If your Income was over 137700 in 2020 132900 in 2019 then all income over that amount does not pay Social Security.

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Even a new 10000 aggregate cap on state and local tax deductions affects states even though it is commonly regarded rightly as a deduction against state tax liability.

. 2019 paid less than the 15 per cent in federal tax in 2019 a surprising number that has the Liberal. Here are the federal income tax brackets for 2019 these apply to income earned in 2019. Now for high income earners.

The 29 tax we already discussed and an extra 09 tax on. Or b made or suffered the making of a contribution to a private retirement scheme approved by the Securities Commission. Final regulations on income tax withholding.

Notes If the tuition fees being transferred to you are not shown on the students tax certificate you should have a copy of the students official tuition fees receipt. 1 Section 491D of the Income Tax Act ITA provides that income tax deduction not exceeding RM3000 can be claimed by an individual who has a paid premiums for a deferred annuity. Taxable income is the amount of income.

The top individual income tax rate was cut from 59 to 54 percent partially offset by a phaseout of high earners federal deductibility and a corporate rate cut is. Thats your total income minus deductions. Erica York Depreciation Requires Businesses to Pay Tax on Income That Doesnt Exist Tax Foundation May 21 2019.

Now for you high income earners. In the long run after-tax incomes rise by about 012 percent overall 011 percent for the bottom 20 percent of earners and 02 percent for the top 1 percent of earners. So when Alexandria Ocasio-Cortez United States Representative from New York floated the idea of a top tax bracket of 70 it doesnt mean the highest-earning taxpayers will pay 70 on all of their income.

Liberals to go further targeting high-income earners with budgets new minimum income tax. This is called the Social Security Cap. The regulations implement changes made by the Tax Cuts and Jobs Act and reflect the.

Final regulations on income tax withholding were published in the Federal Register on October 6 2020 at 85 FR 63019. Medicare can actually be thought of as 2 separate taxes.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Who Pays U S Income Tax And How Much Pew Research Center

Your 2020 Guide To Tax Deductions The Motley Fool

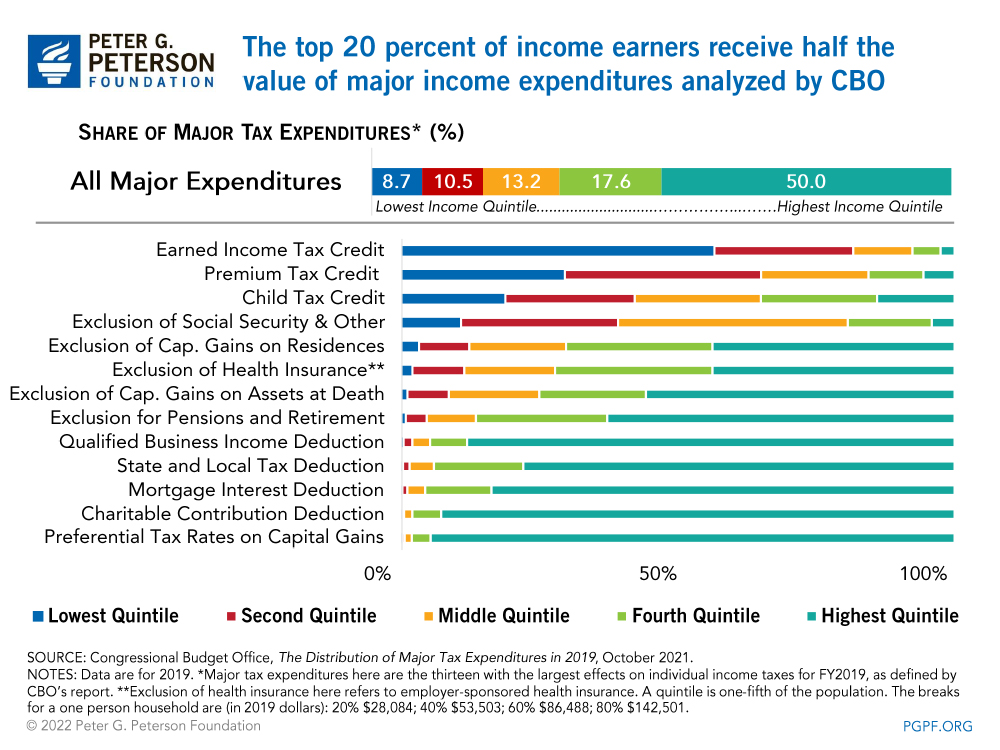

Who Benefits More From Tax Breaks High Or Low Income Earners

How Do Marginal Income Tax Rates Work And What If We Increased Them

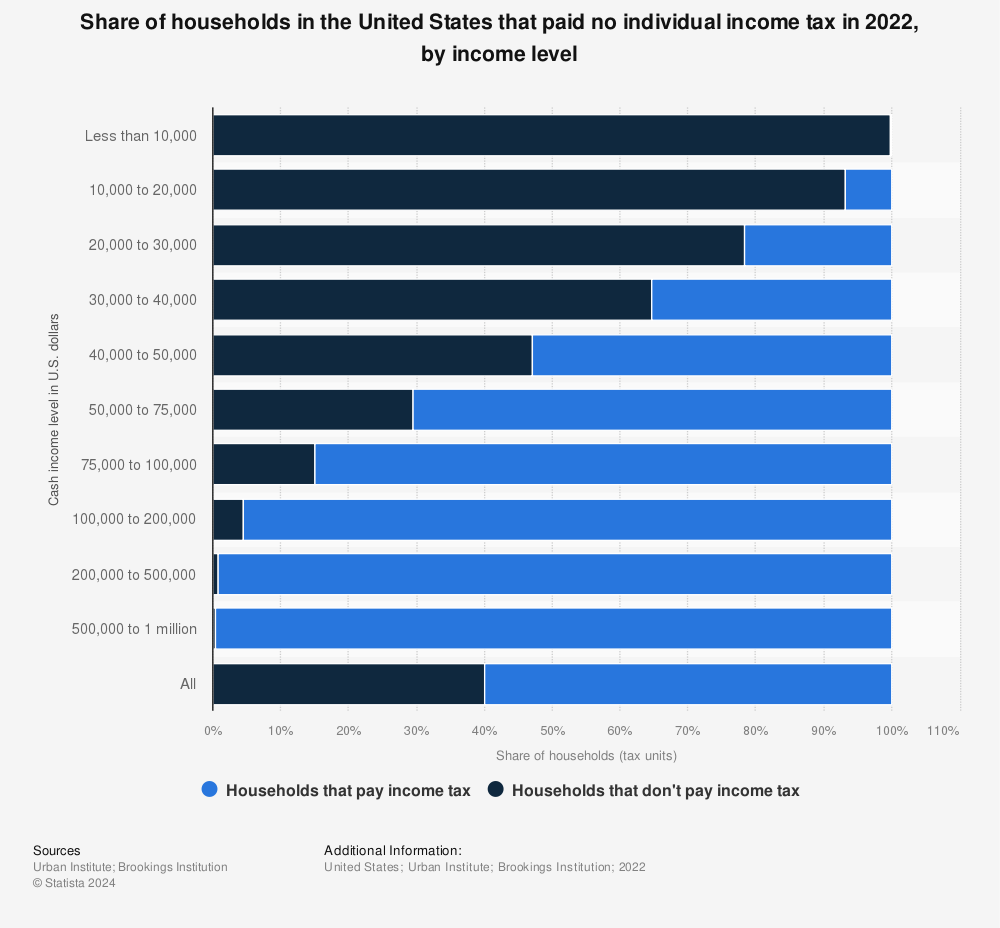

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

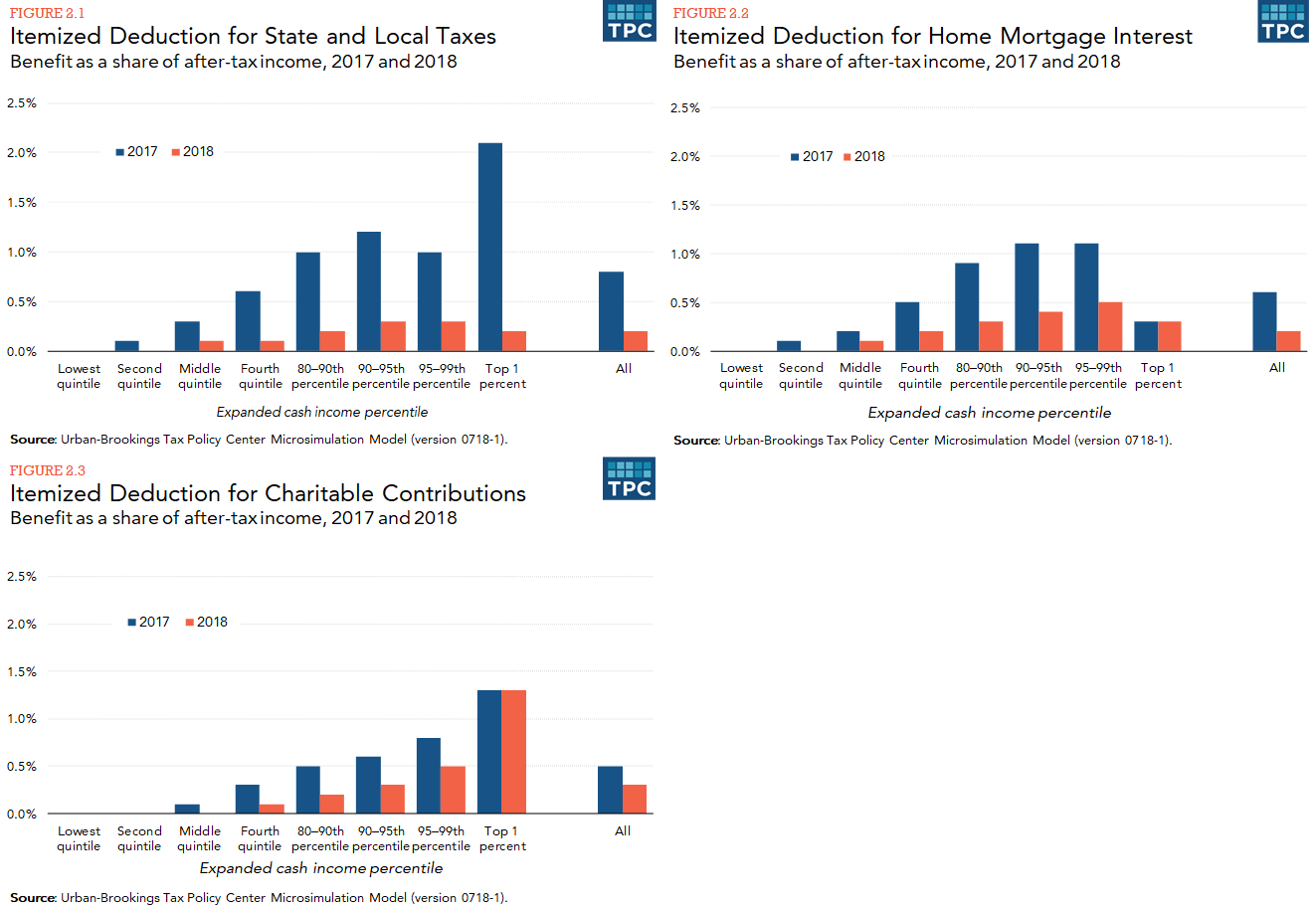

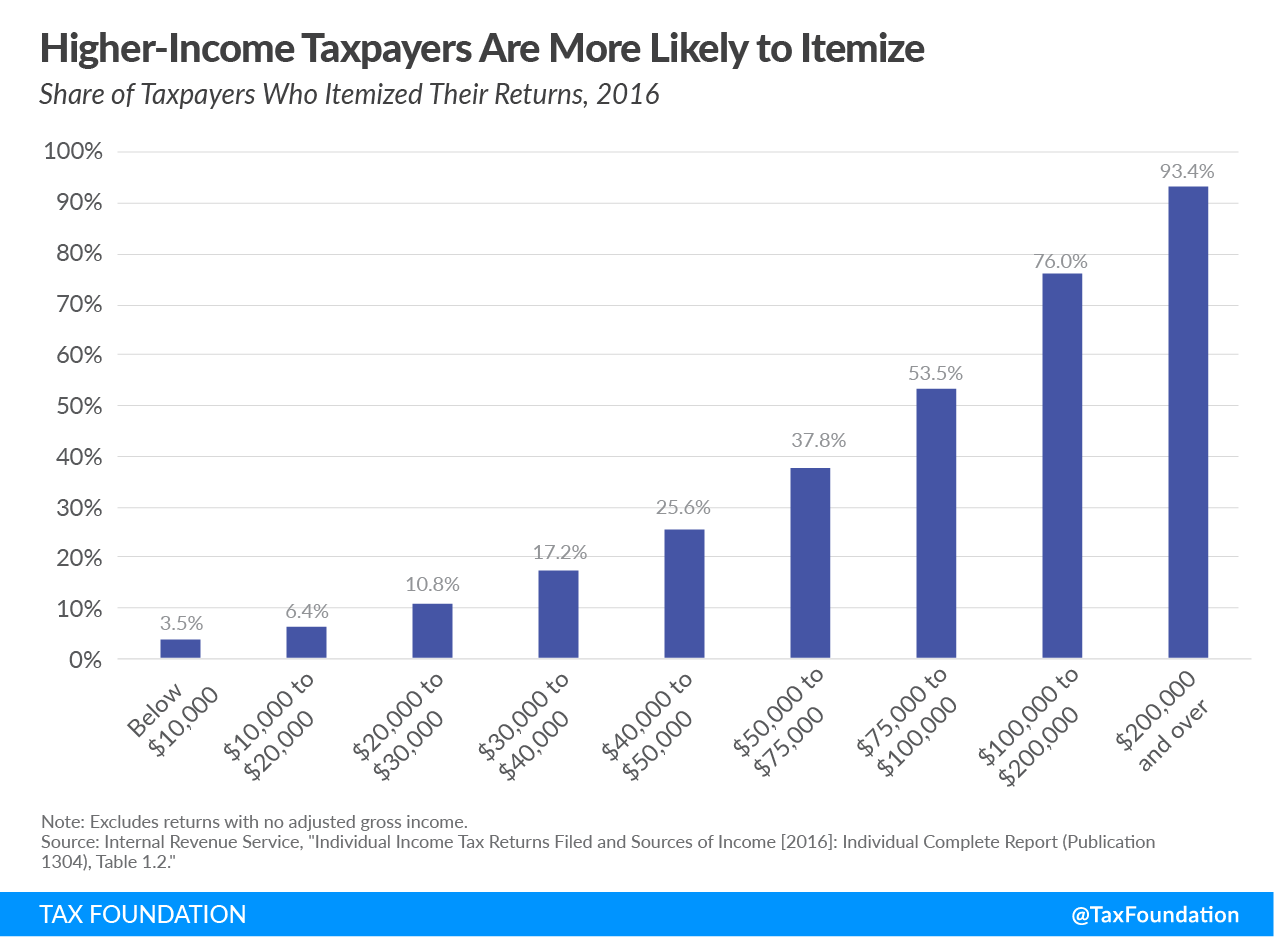

What Are Itemized Deductions And Who Claims Them Tax Policy Center

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

How The Tax Burden Has Changed Since 1960

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

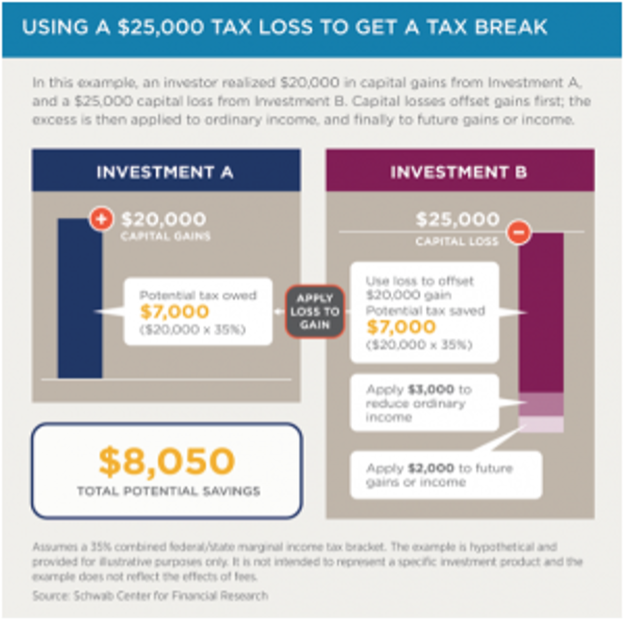

The 4 Tax Strategies For High Income Earners You Should Bookmark

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

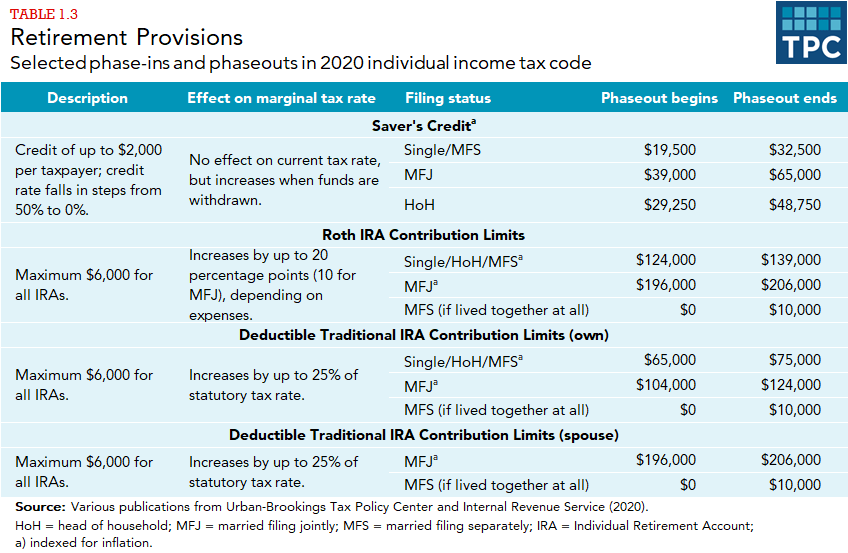

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Itemized Deduction Who Benefits From Itemized Deductions

Tax Strategies For High Income Earners Wiser Wealth Management